$2 billion reasons to offer Brighte finance

Grow your business with access to exclusive government schemes and award-winning finance.

Exclusive finance and administration partner

Brighte’s 0% interest payment plans are a step ahead when pitching to residential customers.”

Warwick Johnston

SunWiz

Numbers that speak for themselves

$2 billion

in applications

Be part of the next billion and grow your business with Brighte.

$280 million

in government funds

Access exclusive government schemes driving growth in ACT and TAS.

180,000+

homes and businesses

More and more Australians are using finance to upgrade sooner.

Empowering businesses like yours

From national organisations to one-man bands, we offer the services and support to grow your business.

-

Solar

Systems -

Battery

Storage -

Solar and Battery Systems

-

Off-grid

Systems -

Solar Hot Water Systems

-

Electric Heating & Cooling

-

Hot Water Heat Pumps (HWHP)

-

Solar Pool Heating

-

EV Charging Infrastructure

-

Plumbing

-

Energy Efficient Products

-

Double

Glazing -

Ceiling

Insulation -

Water Filtration Systems

-

Efficient Electric Stovetops

-

Electrical Upgrades

-

Lighting

-

Guttering

-

Roofing

-

Flooring

-

Blinds, Curtains, Shutters

-

Awnings

Accelerating your growth

Access to exclusive government schemes

Scheme partners have grown their business by at least 300% with Brighte.

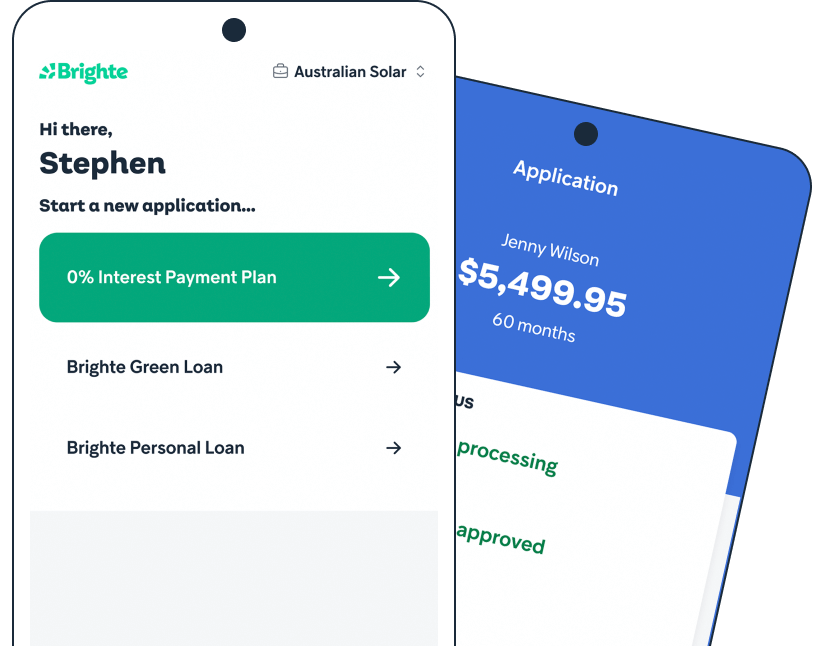

Simple steps to get started

Get accredited

10 minute online sign up

Personalised coaching

Turn selling into growing

Close more deals

Remove barriers with smart finance

Cashflow sorted

Hassle free, next day payment